Ah, the Framing Effect! It’s like a magic trick in the world of psychology, where the same rabbit (information) looks different depending on the hat (context) it’s pulled from. This trickster is particularly sneaky in the world of investing, especially in the crypto-sphere, where fortunes rise and fall faster than a yo-yo champion’s hand.

The Framing Effect: A Quick Psychology 101

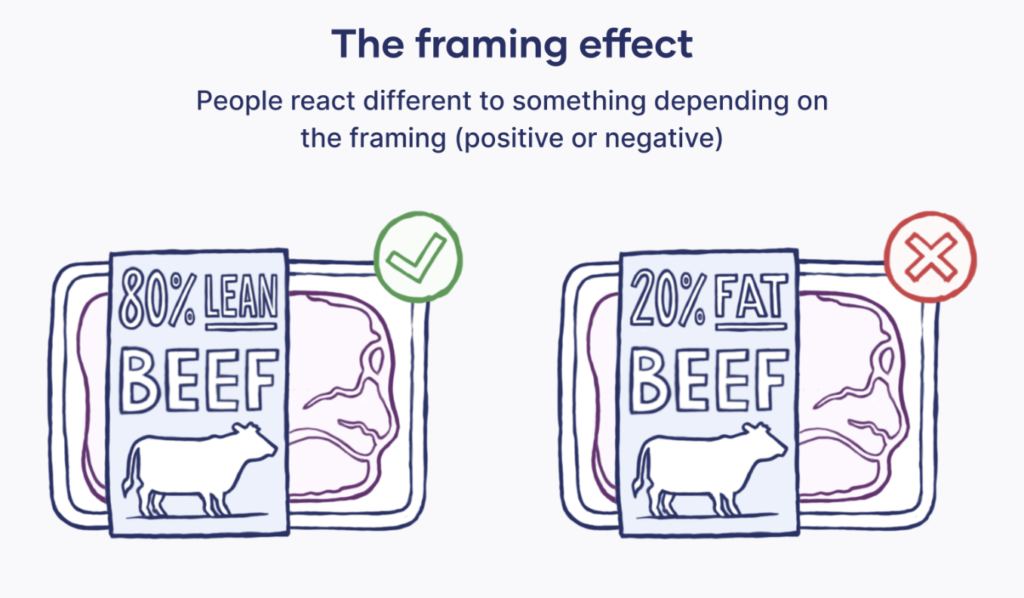

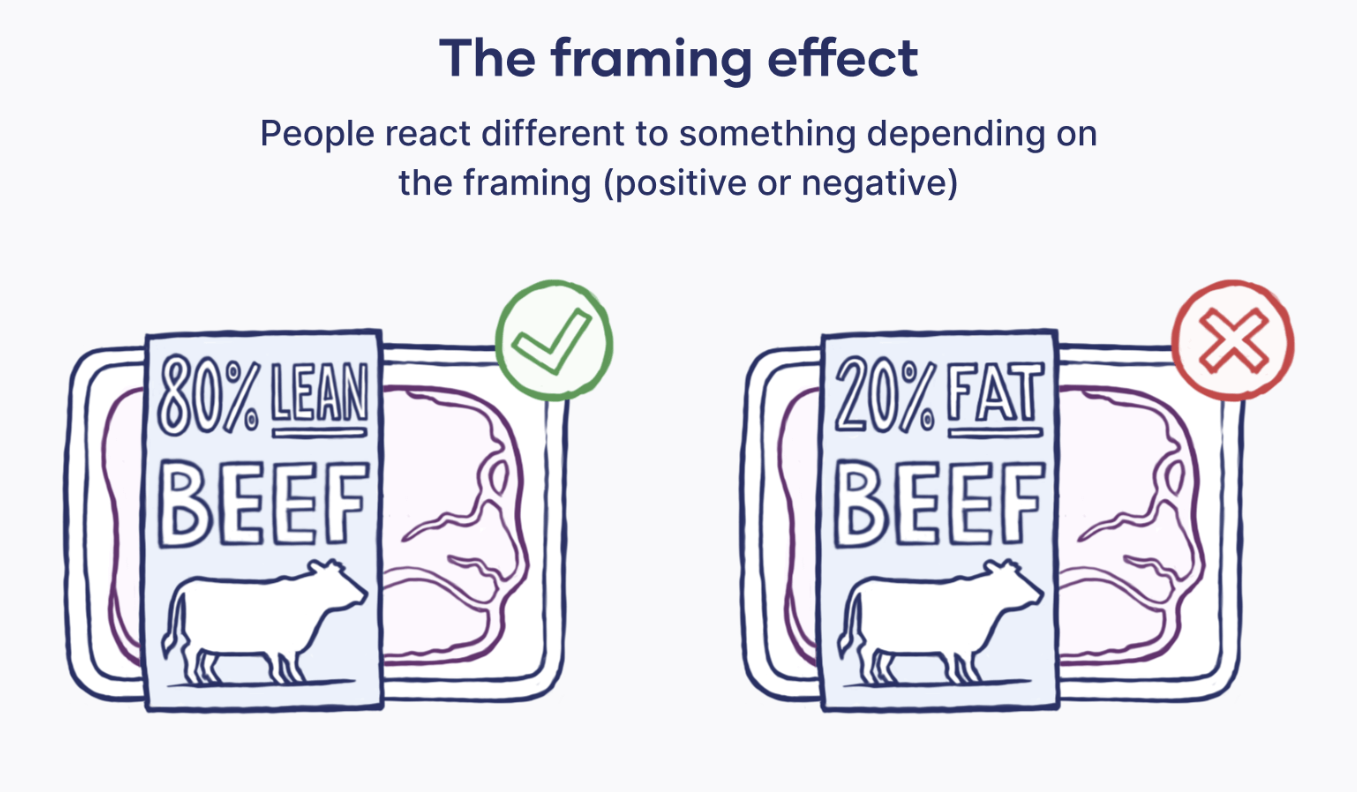

Let’s start with the basics. The Framing Effect is a cognitive bias where people react differently to the same information based on how it’s presented. Imagine two doctors. Doctor A says, “This surgery has a 90% success rate,” while Doctor B says, “This surgery has a 10% failure rate.” Same surgery, different frames. Surprisingly, more people would opt for the surgery with Doctor A, despite the facts being identical.

The Investment World: Where Framing Effect Wears a Disguise

Now, let’s shift gears to the wild world of cryptocurrency investing. In crypto, prices swing like a pendulum on energy drinks. Here’s where the Framing Effect dons its cloak and dagger. A news headline screaming, “Bitcoin drops 10%!” frames the situation as a disaster, prompting panic selling. Another headline saying, “Bitcoin now 10% cheaper!” frames it as a discount sale, triggering a buying spree. Notice the trick? Same price change, different emotional reactions.

How Framing Twists the Crypto Tale

Crypto investors often fall prey to this effect. When prices soar, the media often frames it as the dawn of a new era, luring investors with dreams of Lamborghinis and moon landings. Conversely, when the market plunges, it’s framed as the apocalypse’s rehearsal dinner, leading to panic sells. The trick is recognizing that the underlying asset hasn’t changed – just the way it’s presented.

The Secret Weapon: Awareness

Now, for the superhero twist: awareness. By understanding the Framing Effect, investors can don their mental armor against impulsive decisions. Here’s how:

- Fact-Check the Frame: When you see a headline, ask, “What’s the other side of this story?” Understand that every “crash” can be a “correction,” and every “surge” might be a “bubble.”

- Long-Term Lens: Frame your investments with a long-term perspective. Crypto, like a fine wine, often needs time. Short-term frames can be misleading; long-term views provide clarity.

- Emotion vs. Reason: Recognize when you’re making decisions based on emotions rather than facts. Are you buying because of FOMO (fear of missing out) or because your research supports it?

- Diversify the Narrative: Don’t get all your news from one source. Diversifying your information sources helps balance the framing and gives a clearer picture.

- Reflective Pause: Before making a move, take a breath. Ask yourself, “Am I being influenced by how this information is framed?”

Becoming a Framing-Savvy Trader

Here’s the golden nugget: to be a better trader, be a skeptical optimist. Question the frame, do your homework, and remember that the market’s mood swings are often more dramatic than the reality.

- Educate Yourself: Knowledge is power. The more you understand the market and its trends, the less likely you are to be swayed by sensational framing.

- Develop a Strategy: Have a clear investment strategy and stick to it. This helps you stay the course, even when the framing effect tries to rock your boat. Algorithm trading can reduce the effect of your biases on your investing by decreasing the chance that you’ll bring your emotions to the trading desk. Tools like Good Crypto are a great way to get into algorithmic trading for retail investors without having to move your assets to another platform.

- Embrace Volatility: In crypto, volatility is the norm, not the exception. Frame it as an opportunity, not a threat.

- Mind the Herd: Just because everyone is doing something doesn’t mean it’s smart. Often, the crowd is influenced by framing. Dare to be different when your research supports it.

- Keep Calm and Carry On: Emotional responses are framing’s best friend. Stay calm, and remember that today’s crash could be tomorrow’s correction.

Wrapping It Up

In conclusion, the Framing Effect is like a chameleon in the world of investing, constantly changing colors to match the emotional landscape of the market. By being aware of this psychological sleight of hand, you can see through the illusion and make decisions based on facts, not frames. Whether you’re a seasoned trader or a crypto newbie, remember: the frame is not the picture. Happy investing, and may your crypto journey be as exciting as it is informed!

Leave a Reply