Tag: Investor Psychology

Understanding Escalation of Commitment in Investor Psychology

When it comes to making investment decisions, our minds can sometimes play tricks on us. One such psychological bias that affects investors is known as the “escalation of commitment.” This phenomenon refers to the tendency to continue investing time, money, or resources into a decision, even when evidence suggests that it may be the wrong…

Unraveling the Sneaky Trick of Choice-Supportive Bias in Decision Making

Choice-Supportive Bias: The Sneaky Trick Your Brain Plays on You Have you ever made a decision, whether it’s choosing a restaurant for dinner or picking an investment option, only to later convince yourself that your choice was the best one? If so, you’ve fallen victim to a sneaky cognitive bias known as choice-supportive bias. But…

The Base Rate Fallacy: How Ignoring General Information Can Impact Your Investment Decisions

The Base Rate Fallacy: How Ignoring General Information Can Impact Your Investment Decisions When it comes to making investment decisions, our brains often have a funny way of leading us astray. One common cognitive bias that can trip us up is known as the base rate fallacy. This phenomenon occurs when we ignore general information…

Unmasking Information Bias

The Art of Seeking Knowledge Welcome to the Weekly Wizdom Cognitive Corner! Today, we are diving into the fascinating world of information bias and its impact on investor psychology. So, grab your thinking caps and let’s explore how understanding this bias can help us become better traders. The Allure of Information As humans, we have…

Confirmation Bias in Investing: Unraveling the Psychology of Investor Decision-making

Investing in the stock market is a complex endeavor that requires a delicate balance of analysis, intuition, and decision-making. While many factors influence investment choices, one aspect that often goes unnoticed is the role of confirmation bias in shaping investor psychology. Understanding this cognitive bias and its impact on investment decisions can help traders become…

Understanding Regression to the Mean in Investor Psychology

Have you ever noticed that after a particularly successful investment, your subsequent ventures tend to be less profitable? Or perhaps after a disappointing outcome, your next trades tend to fare better? This phenomenon is known as regression to the mean, and it plays a significant role in investor psychology. In this article, we’ll explore what…

The Narrative Fallacy in Investing: Unraveling the Stories That Influence Our Decisions

Investing is a complex world, where numbers, trends, and probabilities intertwine to create opportunities and risks. However, as humans, we have an innate tendency to make sense of the world through stories and anecdotes. We love narratives because they simplify information, connect dots, and provide a sense of order in a chaotic universe. But when…

The Endowment Effect: Understanding Investor Psychology and Becoming a Better Trader

As human beings, we have a tendency to place a higher value on things we own compared to those we don’t. This cognitive bias, known as the Endowment Effect, has significant implications for investor psychology and can greatly impact our decision-making as traders. In this blog post, we will explore the concept of the Endowment…

Riding the Market Waves: Demystifying the Illusion of Control in Investing

In the grand casino of the stock market, there’s a subtle yet pervasive bluff that even the savviest investors sometimes fall for – the Illusion of Control. It’s like believing you can command the rain to stop just because you bought an umbrella. This cognitive hiccup makes us overestimate our power to control events, particularly…

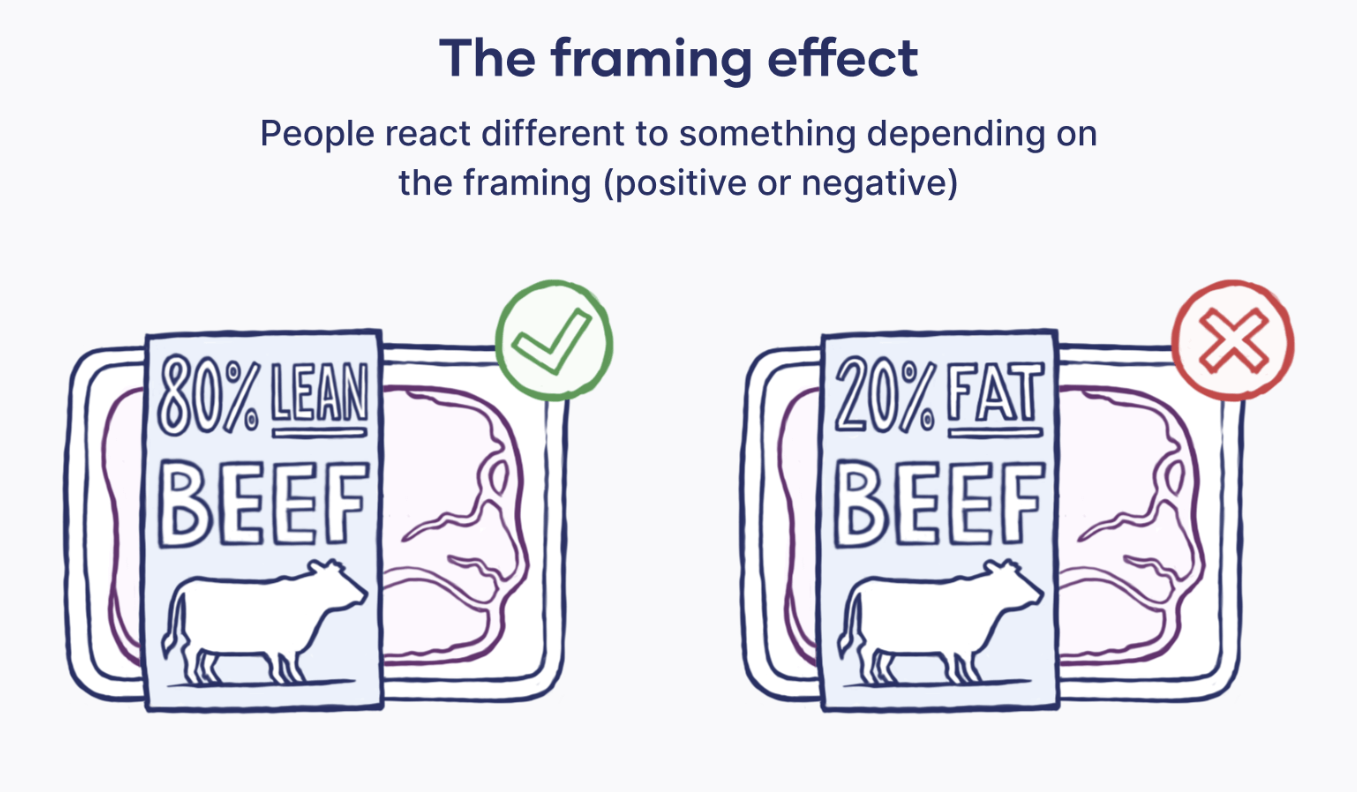

Unframed Reality: Mastering the Crypto Market by Seeing Beyond the Framing Effect

Ah, the Framing Effect! It’s like a magic trick in the world of psychology, where the same rabbit (information) looks different depending on the hat (context) it’s pulled from. This trickster is particularly sneaky in the world of investing, especially in the crypto-sphere, where fortunes rise and fall faster than a yo-yo champion’s hand. The…