Category: Investing

The Endowment Effect: Understanding Investor Psychology and Becoming a Better Trader

As human beings, we have a tendency to place a higher value on things we own compared to those we don’t. This cognitive bias, known as the Endowment Effect, has significant implications for investor psychology and can greatly impact our decision-making as traders. In this blog post, we will explore the concept of the Endowment…

Riding the Market Waves: Demystifying the Illusion of Control in Investing

In the grand casino of the stock market, there’s a subtle yet pervasive bluff that even the savviest investors sometimes fall for – the Illusion of Control. It’s like believing you can command the rain to stop just because you bought an umbrella. This cognitive hiccup makes us overestimate our power to control events, particularly…

Mind Over Market: Dodging the Investment Illusions of the Representativeness Heuristic

In the multifaceted world of investing, there’s a cognitive trickster at play – the Representativeness Heuristic – that often twists our perception with its illusionary magic. This fancy term might sound like something out of a Hogwarts spellbook, but it’s actually a psychological wizardry that plays a significant role in investment decisions, especially in the…

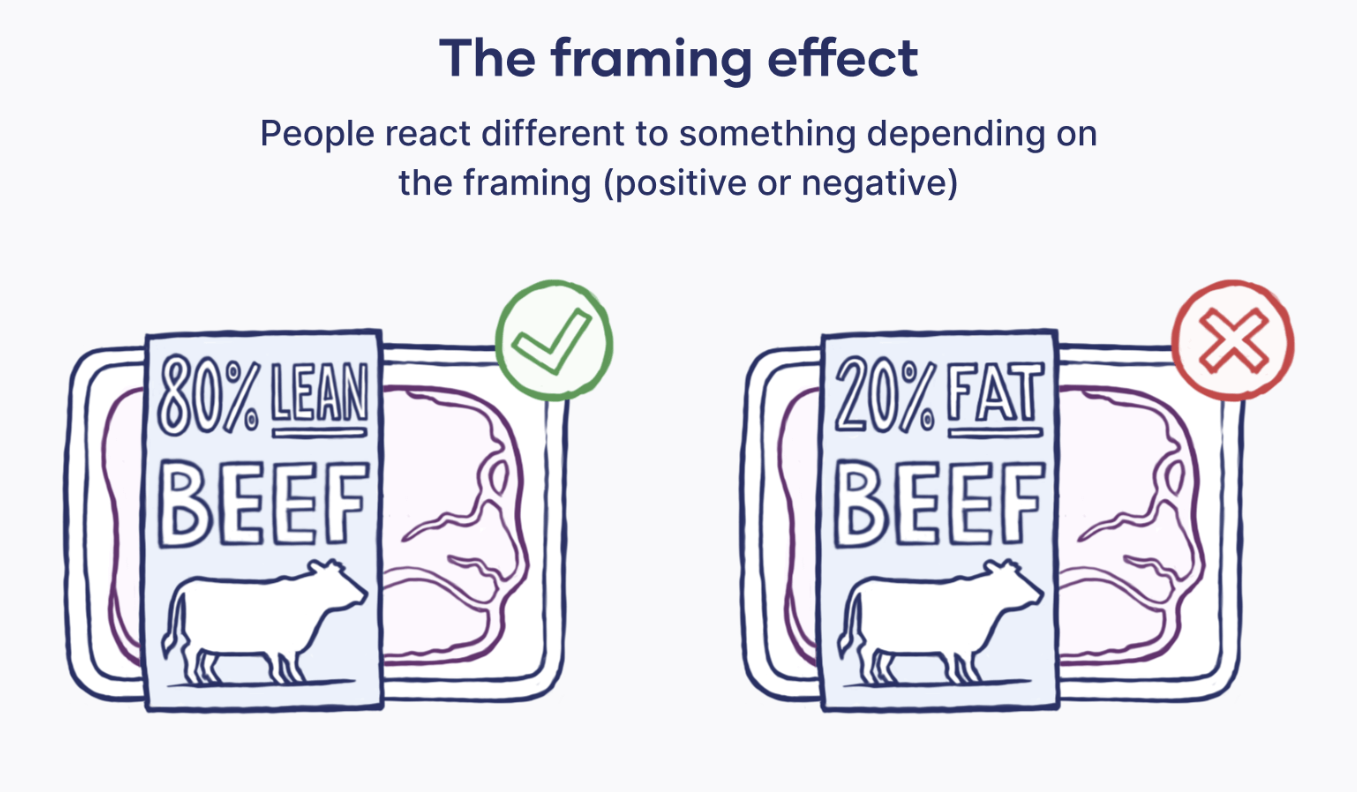

Unframed Reality: Mastering the Crypto Market by Seeing Beyond the Framing Effect

Ah, the Framing Effect! It’s like a magic trick in the world of psychology, where the same rabbit (information) looks different depending on the hat (context) it’s pulled from. This trickster is particularly sneaky in the world of investing, especially in the crypto-sphere, where fortunes rise and fall faster than a yo-yo champion’s hand. The…

The Dunning-Kruger Effect: Don’t Let It Derail Your Investment Strategy

Have you ever come across someone who believes they are an expert in a certain field, but their actual knowledge and skills fall far short? This phenomenon is known as the Dunning-Kruger Effect, and it can have a significant impact on your investment strategy if you’re not careful. In this post, we’ll explore what the…